While this increase reflects the average motorists might see upon renewal, the actual variety in prices authorized is significant: some Ontario vehicle drivers might take pleasure in a reduction in the costs they pay of around 12. 67%, while others might see their prices raise as much as 9.

57% in 2018, which can quickly account for a huge section of increasing insurance in a provided year., helping to lower the expense of driving for those that invested driving safety and security.

laws car insurance insure auto insurance

laws car insurance insure auto insurance

Conserving Cash on Teen Automobile Insurance Coverage So you have actually got your new motorist's license and, as you're most likely aware, it's prohibited to hit the streets without auto insurance. You most likely likewise understand that insurance coverage prices are based on exactly how most likely you are statistically to enter a collision. As a newbie vehicle driver, the numbers aren't on your side.

Yet, there are some points young adults and moms and dads can do to save cash on insurance rates. Obtain on your moms and dads' plan. It's typically less costly to include a young adult to their parents' plan, rather than be insured separately. Many companies won't bill an additional costs until the teen is a qualified chauffeur (cheapest car insurance).

Why Do Car Insurance Premiums Go Up Every Year Fundamentals Explained

Vehicle driver experience (car). Finished Vehicle driver Licensing law calls for teens to log 50 hours with a seasoned motorist, however taking a formal vehicle drivers educating program will likely conserve on insurance coverage. cars.

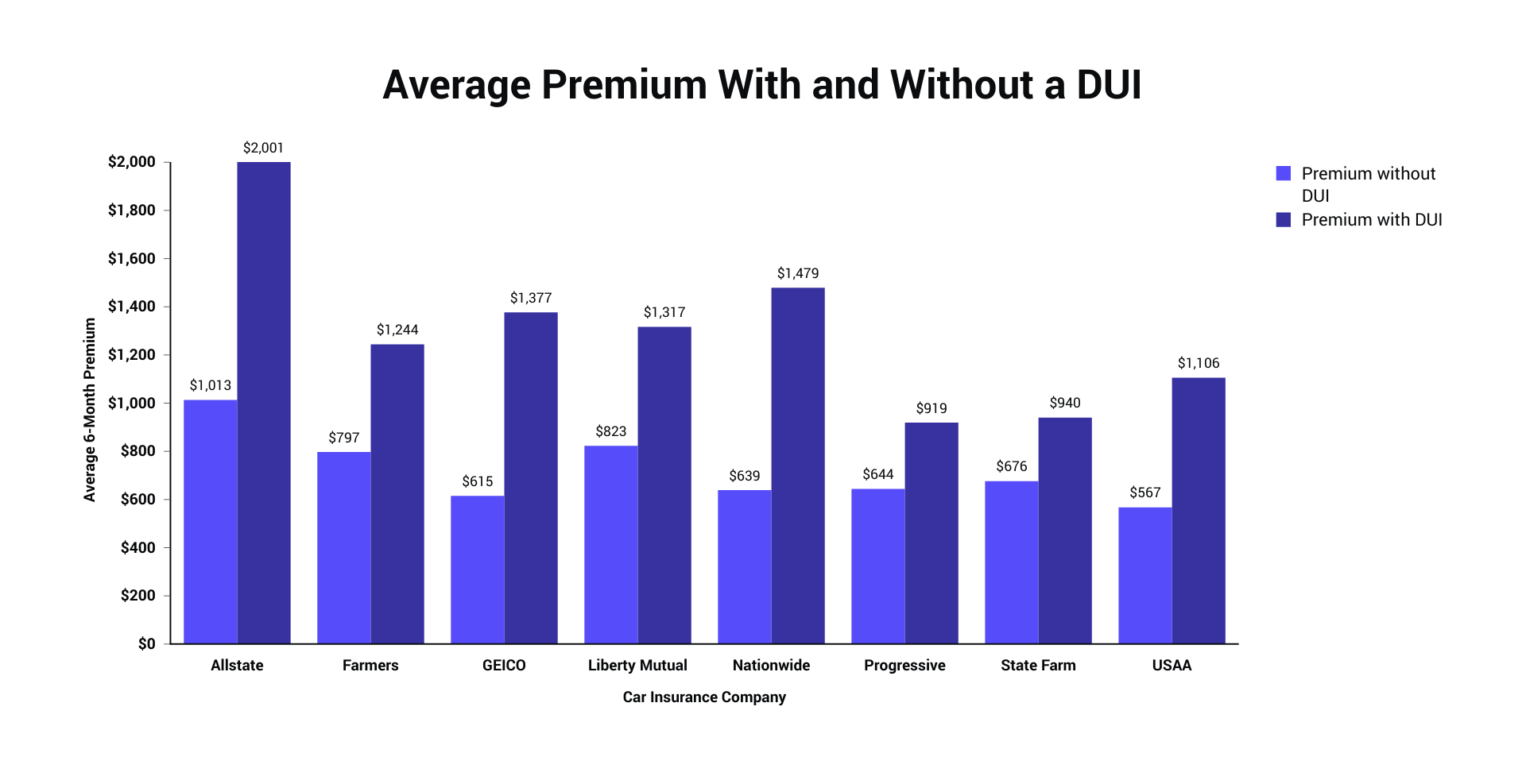

Penalties can land you back in the passenger seat. Fatality and injury are the highest price drivers can spend for drinking and also driving, however also if you manage to make it through, a D. car.U.I. ticket will set you back teenagers big time. As a teen chauffeur, you'll likely be cancelled and also if you can obtain insurance, expect to pay a much higher rate for the next 3-5 years - car.

Rack up even more than 3 and teens face termination or non-renewal. Drive an "insurance policy pleasant" vehicle. Cars that are a preferred target for thieves, are costly to repair, or are thought about "high performance" have a lot higher insurance expenses. Prior to you acquire a car, contact your insurance provider to obtain a quote on what it will certainly set you back to guarantee.

Frequently Asked Questions About Automobile Insurance A.

The 10-Second Trick For Why Is My Car Insurance So High? - Ramseysolutions.com

The highest insurance Click here for info coverage prices are paid by any kind of male motorist under the age of 25. His rate then pivots on whether he's married and also whether he possesses or is the major driver of the auto being guaranteed - insurance company. With the increase in young female chauffeurs in the last twenty years, nonetheless, the crash prices between the genders are evening out. auto insurance.

No. However, you should have a legitimate vehicle driver's certificate. Additionally, in many states, you should be 18 prior to you can own a cars and truck without a grownup's name on the auto registration. A. Car insurance coverage normally last 6 months. Some last one year. You will receive a notice when it's time to renew your insurance policy.

A. Under many scenarios, a person utilizing your cars and truck with your consent is covered by your insurance coverage. If the individual obtains your car with your authorization and is associated with a mishap, your insurance policy will pay simply as if you were the vehicle driver. However, in some states, some insurers might limit the coverage.

In this example, a young motorist might see the cost of their insurance greater than double after one ticket as well as one mishap. Simply to stress, the firm used much better than ordinary protection for our rate examples, not barebones coverage, so they are not the company's cheapest prices. All are based upon the teen driving a 2003 Honda, regular use (auto).

Why Is Car Insurance So Expensive In 2022? - Motor1.com for Beginners

cheapest auto insurance vehicle insurance credit score affordable

cheapest auto insurance vehicle insurance credit score affordable

If you have an older cars and truck with low market value, it may be an excellent idea to lower your premium by getting rid of accident insurance coverage. When you offer your auto to a person and also they trigger an accident, it is their car insurance coverage that will certainly cover the problems on your cars and truck. automobile.

Insurance coverage business analyze details on locations where individuals are most likely to file insurance claims to develop rates. On the various other hand,, is the state with the most inexpensive cars and truck insurance policy prices.

vans insured car insure money

vans insured car insure money

The claims based on area are separated into two classifications: those arising from a vehicle crash as well as those triggered by criminal damage or theft. In general, insurance coverage companies rank the threat of car accident based upon the location where you live, in addition to your danger of automobile burglary or devastation based on the city where you live as well as make a decision the prices basis the chance - insure.

One of the reasons vehicle insurance policy rates differ by state is that each state has its own insurance policy regulations. credit score. Louisiana has a typical insurance price of $2,839 and it is 99% a lot more expensive than the national standard.